Look out below! The plunge in oil prices may not be over just yet.

Oil took another hit Wednesday, sinking below $53 to a level last seen during the Great Recession. It’s hard to recall that crude oil traded for over $100 a barrel as recently as July.

Few saw the energy meltdown coming. Now that it’s here, industry analysts warn another move lower is possible as the momentum remains firmly to the downside.

“If this doesn’t hold, we could go back to price levels in late 2008 and early 2009 — down in the $30s. There’s no reason why it couldn’t happen,” said Darin Newsom, senior analyst at Telvent DTN.

That would be good news for the overall U.S. economy, especially consumers who are saving money each time they fill up their gas tanks. If oil fell to around $40 a barrel, that would translate to a national gas average of roughly $1.80 a gallon.

Yet lower prices are also pinching the oil industry, including the previously red-hot Texan economy and high-cost U.S. shale and Canadian oil sands producers. Several thousand layoffs in the energy sector have already been announced.

Why is oil so cheap? The oil plunge has been fueled largely by excess supply caused by the North American energy revolution.

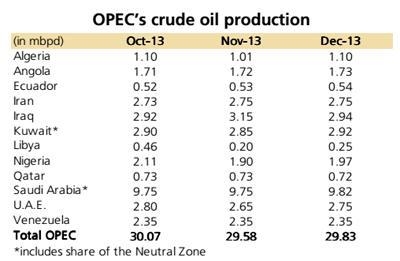

In an effort to squeeze these new players and maintain market share, OPEC exacerbated the oversupply problem by deciding to keep production steady in late November.

“It really is pretty mathematical. There is more oil than we need,” said Tamar Essner, energy analyst at Nasdaq Advisory Services.

Slowing demand for oil: The world’s appetite for oil no longer looks insatiable. That’s largely due to the slowing Chinese economy. The country’s oil demand had been growing at incredible rates, but now it’s in the low single digits.

“Their economy is maturing. Just by definition it’s going to need less oil,” said Essner.

Global demand is also being slowed by the fact that the U.S. and other mature economies have become more fuel efficient.

“If you look out your window and watch cars going by you don’t see huge gas guzzlers as much. When the market spiked to $140, we actually saw a change in consumer habits,” said Newsom.

Now that the U.S. and Canada have moved towards energy independence, scary headlines out of the Middle East no longer seem to spook the energy markets. The so-called “geopolitical risk premium” built into the price of oil has all but vanished.

“So much supply was contingent on the Middle East where there was always the potential for things to go haywire,” said Essner.

She pointed to recent supply disruptions in Libya that had no impact on oil prices. In fact, prices kept dropping.

What’s next: This is hardly the first time oil prices have suffered a dramatic tumble. A supply glut and economic turmoil in Asia caused prices to collapse in the late 1990s.

One key difference between then and now is how much oil has grown as an asset class for investors.

That could increase the chances of a downward spiral as investors panic and dump their holdings, said Tom Kloza, global head of energy analysis at the Oil Price Information Service.

“If panic hits those financial companies that have a lot of exposure to oil on the upside, the numbers you may think are burlesque or hyperbole like $35 or even $25 suddenly become real possibilities, if only for a brief period of time,” said Kloza. “Anything can happen in 2015.”